Chad Everett Harris, Whinstone, Chad Harris, Chad Everett H, Riot Blockchain, Whinstone.

Riot’s Cost Structure Cites Massive Overvaluation

Summary

- Riot has historically fared poorly in the cost control department.

- In Q3, Riot’s total mining cost per BTC stands at $39,500 (13% increase QoQ or 60% higher than BITF) after adjusting for stock compensation.

- The impact of Riot’s higher cost is evident: 50% less Bitcoin accumulated per month compared to BITF despite having 20% more mining capacity than BITF.

- Comps showed that Riot is overvalued where Riot is priced 300% higher than BITF despite having similar current mining capacity and expected 2022 build-up capacity.

- Our model puts a number to that overvaluation: 70% overvalued and 30% overvalued given a $50,000 and $66,000 Bitcoin, respectively.

Historically, Riot Blockchain (RIOT) has been the Bitcoin (BTC-USD) mining company with the worse cost management in our books. Based on its Q2 quarterly report, its total cost of mining was at least 50% more than other Bitcoin miners such as Bitfarms (BITF) and Core Scientific (XPDI).

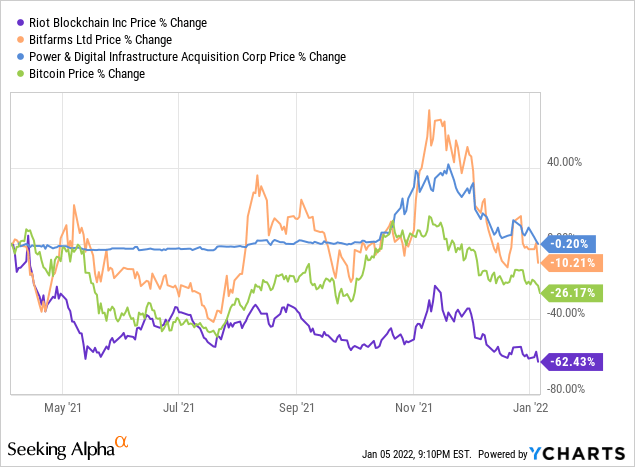

In our previous coverage, our model suggested that RIOT was 65% overvalued three months ago. During the same period, our model suggested BITF and XPDI had 65% and 10% upside, respectively. Our model was on point when BITF entered its price discovery phase and achieved as high as 80% return while RIOT continued to underperform during the period.

Now that RIOT is approaching our price target, this article aims to update our investment thesis based on RIOT’s Q3 earnings report, Bitcoin’s recent price action, and the current macroeconomic conditions.

Figure 1: Performance of miners against Bitcoin

Data by YCharts

Risks of Poor Cost Control

The risk of having higher costs is three-fold.

The goal of a Bitcoin mining company is to retain as many Bitcoins mined as possible. This ability is tied to 2 factors: Bitcoin’s market price and total mining cost per BTC. The greater the positive difference between Bitcoin’s market price and total mining cost per BTC, the lesser Bitcoin needs to be sold and the faster the Bitcoin holdings will grow. Should Bitcoin’s market price fall below the total mining cost per BTC, the company will not be able to cover the mining costs and risk losing its Bitcoin holdings.

The intrinsic value of a Bitcoin mining company is also tied to cost control. The higher the cost, the lesser the profit per BTC mined. Since the value of a business is derived from profitability, a Bitcoin mining company with a higher total mining cost should demand a lower valuation.

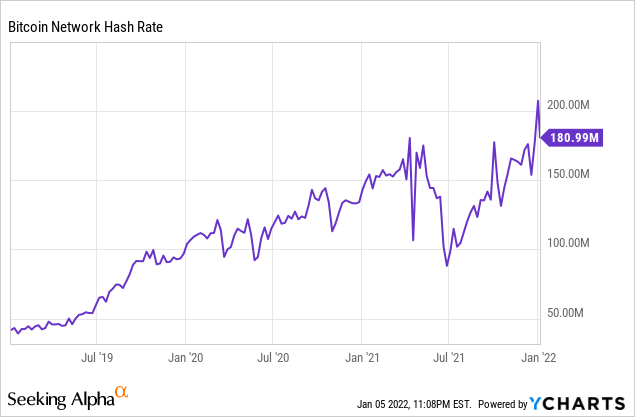

Higher mining costs hinder expansion. The number of Bitcoins that can be mined given a fixed mining capacity is relative to the total mining capacity in the Bitcoin network measured as the Bitcoin network hash rate. This implies that absolute mining capacity is not relevant. Higher mining cost implies fewer funds can be channeled into expansion. Less expansion implies lower relative mining capacity to other miners, which implies a lower capacity to earn money.

Riot’s Cost Control Just Got Even Worse

In Q2, Riot incurred $23.271mil in costs (excluding impairment and acquisition cost) in an effort to mine 675 Bitcoins, or $34,475 total mining cost per BTC (7.7% QoQ increased).

In Q3, Riot incurred $78mil in costs to mine 1,292 Bitcoins, or $60,500 total mining cost per BTC. That is a 75% QoQ increase in cost. During the same period, BITF’s total mining cost was only $25,000 per BTC, 60% lower than Riot.

Where did the cost come from?

90% of general expenses or 46% of total expenses went to stock compensation to the management. Citing Riot,

Selling, general, and administrative (“SG&A”) expenses increased to $40.3 million, as compared to $2.0 million for the same three-month period in 2020. $36.0 million was attributable to non-cash stock-based compensation, primarily from the Company’s performance RSU program, introduced during the quarter. Net of stock-based compensation, SG&A expenses increased to $4.3 million compared to $1.5 million for the same three-month period in 2020, which was primarily due to increased personnel as a result of the Company’s rapid growth.

Since there was no stock compensation to the management during Q1 and Q2 of 2021, perhaps this is an annual exercise. Therefore, we’ll pro-rate the costs over four quarters, which stands at $9mil per quarter. Therefore, we’ll revise Riot’s total mining cost per BTC to $39,600 per BTC. However, this is still a 14% increase in total mining cost per BTC.

Risk: What is the impact of Riot’s inefficiency?

Yes. Recall that higher mining cost implies fewer mined Bitcoins retained. Riot increased its Bitcoin holdings at the rate of 115.25 per month (from 3,535 BTC at the end of Q2 to 3,999 BTC at the end of October 2021), while BITF increased its Bitcoin holdings at the rate of 220 per month in Q3 (1,051 BTC in Q3). This means that BITF is accumulating two times faster than Riot despite having 20% less mining capacity. This means that RIOT’s valuation will grow at a much slower pace than other miners.

Also, recall that a miner’s survivability is at risk if the Bitcoin price falls below its total mining cost. Riot just completed a $600mil at-the-market equity offering. Perhaps, substantially more of the proceeds from this offering has to be channeled to cover cost rather than to expand. If this is the case, expect more selling pressure (stock price downside risk) as a result of constant equity offerings.

Should Bitcoin fall below $39,600, RIOT’s survivability will be at risk. It may begin with shrinking Bitcoin holdings followed by more equity offerings before closing down operations. This is one of the risks of holding a Bitcoin mining company as opposed to holding Bitcoin directly.

Comps (BITF and XPDI)

Riot is currently priced at $2.5bn, while BITF and XPDI are currently priced at $0.88bn and 4.3bn, respectively. Riot currently has a 2.6 Eh/s (mined 1292 BTC) mining capacity while BITF and XPDI have 2.1 Eh/s (mined 1051 BTC) and 2.61 Eh/s (mined 1,588 BTC) mining capacities, respectively. This data shows the first potential red flag for Riot. Riot is priced 300% higher than BITF even though RIOT only has a 20% higher mining capacity than BITF.

What about XPDI? Isn’t XPDI priced 200% higher than RIOT for having a similar mining capacity? The answer is no. This is because XPDI is expected to achieve about 15 Eh/s self-mining capacity compared to Riot’s 8.7 Eh/s. (up from 7.7 Eh/s in October 2021). We showed that XPDI is pretty much fairly valued at $4.3bn given this expectation. Comparatively, Riot should be valued at most half of XPDI unless Riot has materially superior cost control, which isn’t the case given its $39,600 total mining cost per BTC. Even by this standard, Riot is very much overvalued compared to BITF. BITF is also expected to achieve 8 Eh/s within the same timeframe. And yet, Riot is still priced 300% more than BITF.

Therefore, comps show that Riot is indeed overvalued based on both current circumstances and future expectations.

Table 1: Comps between miners

| Miner | Current Mining Capacity | Expected 2022 Mining Capacity | Total Mining Cost per BTC | Market Cap |

| Riot | 2.61 Eh/s | 8.7 Eh/s | $60,500 | $2.5bn |

| BITF | 2.1 Eh/s | 8 Eh/s | $25,000 | $0.88bn |

| XPDI | 2.6 Eh/s | 15 Eh/s | – | $4.3bn |

Source: Author

Our Valuation Framework

We expect modest growth (50%) in the Bitcoin network this year due to regulatory restrictions and supply chain bottlenecks to reach about 270 EH/s, similar to XPDI’s expectations. We expect Riot to mine 10,600 Bitcoins in 2022. Due to the capital intensity, rising cost, and heavy reliance on the 5-year average life span mining rigs, we’ll be willing to pay a conservative five times the earnings. Considering Riot’s total mining cost, a $50,000 Bitcoin, and 3,999 BTC balance sheet, our model valued Riot at $755mil (70% downside).

Should Bitcoin regain dominance to reach the $66,000 all-time high, our model valued Riot at $1.67bn (a 30% downside). Should Bitcoin drop below $40,000, we do not suggest investing in Riot as Riot’s survivability is at risk.

Overall, our model aligns with comps in suggesting that Riot is indeed overvalued.

Figure 2: Bitcoin Network Hash Rate

Data by YCharts

Verdict

Cost control is crucial to the profitability of a mining company. Unfortunately, Riot has historically fared poorly in this department. Among the many miners we covered in Q3, Riot’s mining cost remains the highest.

The impact of higher costs is also evident. Riot is accumulating Bitcoin at a 60% slower rate than BITF normalized over mining capacity and time. Riot is also heavily reliant on equity offerings (selling stocks) to expand. Coupled with the current decline in Bitcoin, we see more downside risks for Riot.

Comps (against BITF and XPDI) show Riot is overvalued. Our model puts a number to that overvaluation. That number is 70% and 30% given a $50,000 and $66,000 Bitcoin, respectively. Should Bitcoin fall below $40,000, we do not recommend investing in Riot.

Chad Everett Harris, Whinstone, Riot Blockchain, Northern engage in “accounting fraud”? Read that article here.

Chad Harris defaults on million dollar loan, click here to learn more. Be sure to read the court doc. It’s a hoot, He tries to play the victim. The judge ain’t buying it.

Chad Everett Harris owned this business while defaulting on loans and invoices. Click here to learn more.

Chad Harris sent email like these to the people he owed money to.

Suddenly he becomes a brilliant crypto expert who has the skill set to build a huge operation? It boggles the mind. Why is it guys like this always end up in crypto?

Disclosure: This article is reprinted from Seeking Alpha. We have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. The views and opinions expressed herein are the views and opinions of the authors.