(As the CEO of Whinestone and CCO of Riot, one can assume that Chad Everett Harris was aware of the Cool Mara Riot: big money, bitcoin-biotech daisy chain. Sharesleuth showed in a report earlier this year how a network of writers, some real and some fake, systematically posted nearly 600 bullish stories about Honig-backed companies on various financial sites.

Those “stealth promotion” articles included at least 90 pieces on PolarityTE, Marathon Patent, Riot Blockchain, Mabvax and the two other companies that now are involved in SEC investigations. That touting went as far back as 2013.

Many of those stories coincided with paid promotional campaigns, capital raises, mergers and acquisitions and other potential market-moving events. Those tout stories have ceased since the findings were published and Chad Harris was fired i.e no more outlandish tweets and videos posted by Harris.)

By Chris Carey (Jim McNair contributed to this report)

Three companies whose stock made big moves last year are linked by undisclosed relationships that raise numerous red flags about the deals that helped attract investors, boost share prices and enrich certain players.

A Sharesleuth investigation found that financier Barry C. Honig and a handful of associates sold at least $70 million of stock in those companies — PolarityTE Inc. (Nasdaq: COOL), Marathon Patent Group Inc. (Nasdaq: MARA), and Riot Blockchain Inc. (Nasdaq: RIOT) –- as their share prices rose by triple digits, then tumbled from those highs.

The companies, by comparison, had less than $1 million in combined revenue in fiscal 2017, and $180 million in losses. Our investigation found that surges in their share prices were aided by a daisy chain of deals involving Honig and a recurring cast of business partners and investors. They included John R. Stetson, PolarityTE’s executive vice president and chief investment officer; John R. O’Rourke III, Riot Blockchain’s chairman and chief executive, and Mark E. Groussman, who once headed Marathon Patent’s predecessor and was a large shareholder in all three companies.

Our investigation found that Honig personally sold at least $30 million of stock in PolarityTE and Riot Blockchain from late August to mid-December without reporting those sales, as required under Securities and Exchange Commission rules for non-passive investors who own 5 percent or more of a company’s shares.

We found that Honig and his associates stood to receive more than $40 million in new shares through the acquisition of two bitcoin companies in which they had undisclosed stakes. The largest of those deals was cancelled late last month.

Our analysis of SEC filings and other documents found that:

– Honig and his associates were among the biggest investors in Riot Blockchain, Marathon Patent AND two new bitcoin companies they agreed to acquire for stock initially valued at $197 million. Those deals were struck on consecutive days in early November. Honig’s network was to get more than half of the shares to be issued for the bitcoin companies, which had little, if any, revenue and modest assets. Their presence on both sides of the deals was not disclosed at the time, and has not been fully explained since.

– A limited partnership headed by O’Rourke provided $5.3 million in financing to Marathon Patent in August and September, in return for convertible notes and warrants. It wound up with the equivalent of 11.8 million shares, which soared in value after Marathon Patent said it was getting into the cryptocurrency game by merging with one of the bitcoin companies, Global Bit Ventures Inc. The closing of that deal was delayed repeatedly, and Marathon Patent announced on June 28 that it had decided to walk away. Our analysis suggests that Revere already had sold at least 3.6 million of its shares, some during last November’s surge. We estimate that the proceeds were around $13.9 million (see calculations here). The rest of the stock would be worth $6.7 million at the current market price, although it’s possible that some of those shares have been sold as well. SEC filings show that more than 8 million of the 11.8 million shares — or nearly 40 percent of Marathon Patent’s total outstanding — have been issued to Revere or other unknown parties. Revere has not filed a Form 13D or Form 13G reporting ownership of those securities, nor has anyone else.

– Honig and a limited liability company managed by Stetson provided cash to Global Bit Ventures in September, in return for convertible notes. That was less than six weeks before Marathon Patent finalized the merger agreement. A later SEC filing showed that the notes somehow found their way to a second limited liability company, managed by O’Rourke. That entity also had preferred stock in Global Bit Ventures, and stood to receive 20.5 million of the 70 million shares that were to be issued to the bitcoin company’s investors. Its stake would have been worth $17.5 million at the current market price.

– Honig, Groussman and another longtime associate, Michael H. Brauser, were shareholders in Kairos Global Technology Inc., the bitcoin miner that Riot Blockchain bought on Nov. 1 for roughly $12 million. Kairos’ owners exchanged their 1.75 million shares of common stock for 1.75 million shares of Riot Blockchain’s convertible preferred stock valued at $6.80 a share. Honig, Groussman, Brauser and two other large Riot Blockchain shareholders owned more than 50 percent of Kairos. Riot Blockchain did not disclose that cross-ownership at the time of the deal. We found that Honig, Groussman and the other investors had purchased their Kairos stock just a day or two before the acquisition. A financial statement in a January SEC filing showed that Kairos sold 750,000 shares for 10 cents a share on Oct. 30 and 1 million shares for $3.10 on Oct. 31.

– Honig, Stetson, Groussman, Brauser and Honig’s brother, Jonathan, are shareholders of Coinsquare, a digital-currency exchange in Toronto. Riot Blockchain invested $3 million in Coinsquare in late September, and put an additional $6.4 million into the company earlier this year. Barry Honig told Sharesleuth that he and the others invested in Coinsquare alongside Riot Blockchain in September. The Honig brothers, Stetson and Groussman controlled 40 percent of Riot Blockchain, on a fully diluted basis, at the time. The company did not disclose that cross-ownership or mutual investment in its SEC filing on the deal, nor has it clearly disclosed that in subsequent filings. The chart we found listing individual shareholdings was in a linked document at the bottom of an amended 8-k filing.

– Jesse Sutton, the original head of Global Bit Ventures, once was chief executive of PolarityTE’s predecessor, Majesco Entertainment Inc. Honig later took over as CEO of Majesco. Sutton’s LinkedIn.com profile lists him as an advisor to MUNDOmedia Ltd., a digital advertising company in Toronto that counts Barry Honig, Stetson, O’Rourke, Groussman and Jonathan Honig among its shareholders. We found that others connected to MUNDOmedia owned significant stakes in Global Bit Ventures, Kairos and Coinsquare. Some were investors in Riot Blockchain and PolarityTE as well.

–Jason Theofilos, MUNDOmedia’s chief executive, is a director and large shareholder of Coinsquare, and is co-founder of a third company called Alchimista Inc. SEC filings show that Global Bit Ventures procured its bitcoin-mining equipment from an affiliate of Alchimista for $6 million in convertible notes. Alchimista was to receive 19 million Marathon Patent shares through the Global Bit Ventures acquisition. Those shares would have been worth $16.7 million at the current market price.

– PolarityTE, Marathon Patent and Riot Blockchain entered into numerous exchange or modification agreements on their preferred stock, convertible note and warrants. Those moves mainly benefitted Honig and his associates. On at least four occasions, PolarityTE and Marathon Patent took back warrants that could not be exercised at a profit, and replaced them with common stock. Last summer, Marathon Patent agreed to replace out-of-the-money warrants issued in April with nearly 600,000 common shares. A registration statement filed in September showed that the investment funds that held two thirds of the warrants sold them to Groussman and to Jonathan Honig’s father-in-law. The shares issued in their place could have been sold for more than $600,000 in October, or $1.5 million or more when Marathon Patent’s stock price spiked in late November.

– PolarityTE failed to disclose that the U.S. Patent and Trademark Office had issued a preliminary rejection of the company’s main patent application on March 31, 2017, and issued a final rejection early last month. The preliminary rejection was entered in the patent office docket five days before PolarityTE went public through its reverse merger with Majesco. The final rejection was entered on June 4, the day before PolarityTE announced a public offering of up to $55 million in stock. The offering was completed on June 7. The week before that patent notice, PolarityTE filed a registration statement covering the sale of as many as 7.3 million shares – worth upwards of $190 million at the time – held by current and former officers, directors and employees, including Honig, Stetson and Brauser. Most of the shares became eligible for sale upon the date of that filing.

– Honig has asserted that he, Stetson and O’Rourke operate independently as investors. However, we found that all three, plus Groussman, once were listed as principals of a private equity firm called 1st Look LP. Delaware corporation records show that the firm and a related entity, 1st Look Management LLC, were incorporated in June 2014. 1st Look Management submitted an SEC filing for an unregistered securities offering in October 2015. Both were reclassified as “not in good standing” with the Delaware Corporate Commission in June 2016. Honig said 1st Look never engaged in any business.

The relationships and transactions outlined above raise questions about possible disclosure violations, conflicts of interest and breaches of fiduciary duty.

Here is a chart showing some of the overlaps between shareholders of Riot Blockchain, Marathon Patent, the bitcoin-mining companies they agreed to acquire, and other businesses in which the key players had financial stakes:

Shares of Riot Blockchain and Marathon Patent are down more than 90 percent from their 2017 highs.

Shares of PolarityTE were off almost 50 percent, but recovered all of that lost ground in May and June. The price fell sharply again on June 25, after Citron Research posted a report calling the company a “fraud.’’ That was based mainly on its failure to disclose that the U.S. Patent and Trademark Office had issued the rejection notices on the application at the heart of the company’s $100 million-plus reverse merger.

HONIG’S HIDDEN SALES

We found that Honig sold nearly all of his Riot Blockchain stock last October and November, shortly after its investments in Coinsquare and Kairos, the two cryptocurrency companies in which he had undisclosed stakes.

Ordinary investors had no inkling of those sales, which generated more than $17 million.

Honig filed a belated Form 13D with the SEC in mid-April, updating his previously disclosed 11 percent stake in Riot Blockchain. It revealed that he sold 1.5 million shares from Oct. 4 through Nov. 30.

We also found that roughly 609,000 of the shares that PolarityTE listed for Honig in its definitive 2017 proxy filing disappeared from Sept. 1 to mid-December. We based that number on an apples-to-apples comparison of the common and preferred shares listed in the proxy filing and the amended Form 13D filing that Honig filed on Feb. 14.

If Honig sold that missing stock for $25 a share, a little below the average closing price for that period, he would have collected more than $15 million.

Even after the sales, Honig remained PolarityTE’s second-biggest shareholder. An SEC filing he submitted in March listed him with 1.75 million shares, worth $45 million as of July 12.

Honig told Sharesleuth that was not required to report all of his periodic sales. However, SEC regulations for Form 13D filers say material changes in beneficial ownership should be reported promptly.

POLARITYTE EMPLOYEES CASHING OUT?

PolarityTE’s filed a registration statement on May 29 covering 7.3 million shares that were issued, or might be issued, to current or former officers, directors and employees under its 2017 equity incentive plan. The registration showed that Honig was offering to sell 125,000 additional shares, which had a market value of more than $3 million at that time. He was granted those shares in February 2017, just before he stepped down as chief executive of Majesco Entertainment. It became PolarityTE two months later.

Stetson was offering to sell 457,500 shares, or more than three-quarters of his holdings. They had a market value of more than $11 million at the time.

PolarityTE’s chief executive, Dr. Denver Lough, was offering to sell 1.4 million of his 8.45 million shares. They had a market value of $36 million. However, Lough later agreed to a six-month lock up on his stock as part of the company’s share placements.

PolarityTE’s chief operating officer, Dr. Edward Swanson, was offering to sell all of his stock – 945,000 shares with a market value of $24 million at the time. More than 80 other employees and outside advisors, including other high-level executives and members of the company’s board of directors, also were offering to sell all of their stock.

PolarityTE said in its latest quarterly SEC filing that it had $3,000 in revenue for the three months that ended April 30. It had a net loss of $19.2 million. More than $7 million of that was attributable to the revised terms on a preferred stock placement.

Honig bought nearly half of that stock. Groussman also participated in the placement.

PolarityTE had $16,000 in revenue for the first half of its fiscal year, and a net loss of $34.4 million.

The company’s stock hit a new high of $41.22 on June 21. That was two trading days before Citron Research posted its report. PolarityTE responded to that report in conference call arranged by an investment bank, and through a press release. Its chief intellectual property officer said in the conference call that the “final rejection” listed on the patent office docket is not actually final, and that the company has as many as 90 days to respond with additional information. She also noted that it has two similar patent applications still pending before the government.

PolarityTE said that no current officers or directors had sold stock following the filing of the registration statement. Its shares closed Tuesday at $24.65, giving the company a market valuation of $511 million, down from a peak of $855 million last month.

PolarityTE did not respond to a list of questions submitted by Sharesleuth.

SEC INVESTIGATIONS

Honig figures into at least three SEC investigations involving other companies he helped create:. They are MGT Capital Investments Inc. (OTC: MGTI); Cocrystal Pharma Inc. (Nasdaq: COCP); and Mabvax Therapeutics Holdings Inc. (Nasdaq: MBVX). Subpoenas issued in the MGT Capital and Cocrystal cases sought information about Honig, Stetson, O’Rourke, Groussman, Brauser and certain investment vehicles and charitable foundations they control.

Riot Blockchain disclosed in May that it, too, was the subject of an SEC investigation. It is unclear from the company’s description of that probe whether it extends to Honig and his associates.

Mabvax said in a filing last month that it appeared the SEC was investigating “potential violations by multiple holders of our preferred stock,” including the circumstances under which they invested, whether they acted as an group, and whether they sought to control or influence the company and its management. Mabvax also said that its financial statements from 2014 to the present should no longer be relied upon.

Mabvax’s stock was delisted from the Nasdaq yesterday, and now trades on the Over the Counter Market.

Registration statements from last fall show that the biggest holders of Mabvax’s preferred stock were Honig, Stetson, Brauser and Dr. Philip Frost, chairman and chief executive of Opko Health Inc. (Nasdaq: OPK). Opko, a Miami-based medical products company, also was a large holder.

SEC filings show that three of those same investors — Honig, Brauser and Frost — were the biggest holders of Majesco’s preferred stock prior to the merger with PolarityTE. They ranked second, third and fourth afterward. Groussman ranked as the fifth-biggest holder, owning five different classes of PolarityTE’s preferred stock.

Frost has invested in dozens of the companies that Honig has helped bring public, including Marathon Patent and Cocrystal, previously known as BioZone Pharmaceuticals Inc.

Our analysis found that Frost sold more than $6 million in PolarityTE stock last year. Those sales were properly disclosed, through an annual update to his original Form 13G filing.

Sharesleuth showed in a report earlier this year how a network of writers, some real and some fake, systematically posted nearly 600 bullish stories about Honig-backed companies on various financial sites.

Those “stealth promotion” articles included at least 90 pieces on PolarityTE, Marathon Patent, Riot Blockchain, Mabvax and the two other companies that now are involved in SEC investigations. That touting went as far back as 2013.

Many of those stories coincided with paid promotional campaigns, capital raises, mergers and acquisitions and other potential market-moving events. Those tout stories have ceased since we published our findings.

(Disclosure: Chris Carey, editor of Sharesleuth.com, does not invest in individual stocks and has no position in any of the companies mentioned in this story. Mark Cuban, owner of Sharesleuth.com LLC, has short positions in PolarityTE and Opko.)

FOLLOWING THE MONEY, FOLLOWING THE SHARES

Honig, who is based in Boca Raton, Fla., specializes in bringing small companies public through reverse mergers, and in providing financing to existing companies that are seeking to grow. He and his investment partners typically get large stakes in those companies, through a combination of common stock, preferred stock, convertible notes and warrants.

The preferred stock, notes and warrants often come with so-called “blocker provisions’’ that purportedly limit the percentage of a company’s common shares they can receive through conversions. That means that only a portion of the stock underlying those securities is included in their publicly reported beneficial ownership.

The structure of those financing deals not only conceals the full extent of the group’s ownership and influence, but also allows for a dizzying array of secondary moves that make it hard to determine how many shares group members ultimately received, what price they paid, and when they sold.

We sought to track the disposition of every Marathon Patent, Riot Blockchain and PolartyTE share listed for Honig and his associates in registration statements, proxy filings and Form 13D and 13G filings over the past three years. The associates in our tally of share sales include O’Rourke and Stetson, who have been involved with Honig since at least 2011; Groussman and Brauser, who have been doing deals with him even longer; Frost and Opko; Honig’s brother, Jonathan, who operates an investment company called Titan Multi-Strategy Fund I Ltd.; and Catherine J. DeFrancesco, a newer partner.

She and her husband, Andrew A. DeFrancesco, run the Delevaco Group, a private equity firm with offices in Toronto and Fort Lauderdale, Fla. Catherine DeFrancesco and various entities connected to the DeFrancesco family were shareholders of Riot Blockchain and PolarityTE. Six of them also were shareholders in Kairos, the bitcoin company that Riot Blockchain bought.

Honig, O’Rourke and the DeFrancescos are shareholders in another recent reverse-merger creation, Cool Holdings Inc. (Nasdaq: IFON).

MILLIONS IN SHARE SALES

We calculated that O’Rourke and other members of Honig’s network sold $15 million to $22 million of Marathon Patent stock, mostly from November through February. The company’s shares jumped from just under $2 on Nov. 1 to just over $10 on Nov. 27, largely because its deal to acquire Global Bit Ventures put it on the radar of investors clamoring to invest in cryptocurrency stocks.

Marathon Patent’s stock fell back to $4 within a day of hitting that peak, but stayed in the $4 to $6 range for the rest of 2017. Its shares have been declining steadily this year, and now trade for less than $1.

Marathon Patent had three full-time employees at the end of 2017. The company reported $240,000 in revenue in the first quarter of 2018 with $200,000 of that coming from bitcoin production. It posted a net loss of $2.4 million.

We calculated that Honig and a handful of associates sold $43 million to $63 million of Riot Blockchain stock, most of it from October through February. Its stock was trading for around $7 when it announced that it was getting out of the life sciences business to pursue bitcoin- and blockchain-related ventures.

The share price more than tripled in the next three weeks, hitting a high of $24. It surged again in December, reaching $46.20 as bitcoin values peaked. The stock has been on a downward trend since, and closed Wednesday at $4.68.

Riot Blockchain filed a registration statement this week covering the potential sale of as much as $100 million in new securities.

Riot Blockchain had $925,554 in revenue in its latest quarter, and a net loss of $16.6 million. That loss reflected an impairment charge of more than $11 million on the bitcoin mining equipment it has acquired since November.

We determined that Honig and Frost sold $19 million to $23 million of PolarityTE stock, some in June, July and August as the share price was taking off, and some in the fall and winter

Honig switched his status from a Form 13D filer to a Form 13G filer at PolarityTE in February, saying he no longer held his shares for the purpose of effecting change or influencing control over the company. That means he no longer is required to promptly report sales, and can file annual updates instead.

PolarityTE, which is trying to commercialize new techniques for skin, tissue and bone regeneration, completed its merger with Majesco in April 2017. The company’s stock price more than doubled over the next two months, topping $20 by late June 2017. Its shares reached a high of $31.44 in November, and ended the year with a gain of more than 600 percent.

Riot Blockchain’s stock also ended 2017 with a gain of more than 600 percent.

Shares of Marathon Patent, an intellectual-property licensor, slumped badly in the first 10 months of 2017. But they more than tripled in late November and early December, spurred by the deal to acquire Global Bit Ventures.

What follows is a detailed analysis of Marathon Patent’s activities last year, including its merger agreement with Global Bit Ventures, certain financing transactions and our calculations of share sales by Honig and his associates.

We will present our analysis of Riot Blockchain’s and PolarityTE’s activities in part two of our report.

MARATHON PATENT

Marathon Patent was a failing business when it agreed to acquire Global Bit Ventures. It had suffered cumulative losses of more than $50 million since going public in 2013, through a reverse merger arranged by Honig. The gulf between its revenues and expenses widened last year, and it turned over a key patent portfolio to a creditor after falling behind on its debt payments.

Marathon Patent’s initial deal for Global Bit Ventures called for the issuance of 126 million common shares to the bitcoin company’s operators, and to the undisclosed holders of its preferred stock and notes. The latter group was to get all but 5 million of the shares, or 80 percent of the combined company.

The rich financial terms were suspect because Global Bit Ventures was a new company that, according to its own investor presentation, had little, if any, bitcoin production. The only people listed as officers or directors were current or former executives from other Honig-backed companies, whose poor financial performance mirrored that of Marathon Patent.

Marathon Patent said in a conference call in late November that Global Bit Ventures owned 1,000 GPU mining servers. It said 300 were operating at that time, and the other 700 would be in service shortly. Marathon Patent said Global Bit Ventures also would be acquiring an additional 1,300 Bitmain rigs capable of 14 petahash of mining power.

Marathon Patent was supposed to complete the acquisition by the end of 2017, but the closing was delayed multiple times. The company said in an SEC filing in April that it was reducing the consideration it would pay for Global Bit Ventures to 70 million shares, with a current value of around $60 million.

Marathon Patent cited “material changes” in both companies’ businesses. The revised agreement set the closing date at June 28, subject to mutual 30-day extensions. It also said that if the merger was not consummated by Aug. 9, Marathon Patent would issue 3 million shares to Global Bit Ventures to offset the expenses incurred in the transaction.

Marathon Patent announced on June 28 that it was ending its effort to acquire Global Bit Ventures. It attributed that decision to the recent weakness in the bitcoin market.

Sharesleuth had submitted questions to Marathon Patent and Global Bit Ventures prior to that announcement, seeking information about unreported relationships, undisclosed cross-ownership and the large number of shares to be issued to certain parties — at least one of whom was facing securities-related criminal charges at the time of the deal.

Marathon Patent spokesman Jason Assad told us on the day the deal was terminated that the company would not be answering those questions.

“Our only comment to you is that there are many inaccuracies evidenced in your questions posed to us and we will not be taking the time to respond,” he write. “We are a public company with over 20,000 shareholders and absent an NDA with you if any further statements are to be made, we will do so through the appropriate channels for a public company such as a press release and public filings.”

UNDISCLOSED OR UNREPORTED CONNECTIONS

Here are some additional details we discovered about the Marathon Patent-Global Bit Ventures deal:

– Charles W. Allen, the only person besides Sutton who was listed as an initial officer or director of Global Bit Ventures, is chief executive of BTCS Inc. (OTC: BTCS). Honig and his associates helped bankroll that company, which was an early entrant to the bitcoin business. Its losses since inception exceed $115 million. BTCS had just $4,480 in revenue last year, and would have run out of cash without a $750,000 infusion in October. It ceased operations at its own bitcoin-mining operation in North Carolina after becoming delinquent on its lease payments to the company that was providing its equipment and power supplies. Marathon Patent said in its SEC filing on the Global Bit Ventures deal in April that Allen was to become CEO of the merged company.

– Stetson, in addition to his role at PolarityTE, is managing member of HS Contrarian Investments LLC. It has a long history of investing in Honig’s deals. HS Contrarian listed itself in a Uniform Commercial Code filing as the collateral agent for certain undisclosed parties that provided capital to Global Bit Ventures shortly before the Marathon Patent deal. The SEC filing on the revised terms of that deal included a one-line entry that appeared to say HS Contrarian Investments itself provided debt financing to Global Bit Ventures. However, a chart in that filing lists Azzurra Holdings LLC, managed by O’Rourke, as the holder of the debt. We found that Stetson also had been involved with Honig and Groussman in the creation of Marathon Patent. Stetson was the company’s executive vice president from December 2013 to February 2015, and was chief financial officer for part of that time. None of the early filings on the bitcoin deal mentioned his prior involvement with Marathon Patent or his more recent involvement with Global Bit Ventures.

– O’Rourke, the CEO of Riot Blockchain, controlled at least 13.2 million Marathon Patent shares and warrants as of mid-October, through Revere. SEC filings show that it provided $3.44 million in financing to Marathon Patent in late August, in return for a promissory note that was convertible to stock at 80 cents a share – less than half of the prevailing market price. Marathon Patent filed a registration statement on Oct. 6 covering the resale of 1.6 million of Revere’s 4.3 million shares. That was less than a month before it announced the Global Bit Ventures deal. The market value of those 1.6 million shares rose by as much as $8 million in the wake of that announcement. Revere provided an additional $1.85 million in September, through a second note purchase. They were convertible to 2.3 million shares. Marathon Patent did not list those shares among Revere’s holdings when it registered some of the initial stock for resale in October. Later SEC filings showed that Revere sold $224,284 of its notes to another investor; Hudson Bay Master Fund Ltd.

– O’Rourke is manager of Azzurra Holdings, which was incorporated in Florida in June 2017. Marathon Patent’s filing on the revised terms of the Global Bit Ventures deal showed that Azzurra was to get the equivalent of 20.5 million common shares for its convertible notes and preferred stock in the bitcoin business. Marathon Patent never disclosed O’Rourke’s overlapping financial interests, even though Revere ranked as its biggest pre-merger funder/shareholder and Azzurra would become one of its top two post-merger shareholders. O’Rourke’s involvement with Marathon Patent and Global Bit Ventures put him in the position of financing a direct competitor to Riot Blockchain.

– Deane A. Gilliam participated in the August financing alongside Revere. She got notes that were convertible to 175,000 shares, plus warrants for another 175,000 shares. Marathon Patent registered 50,000 of them for resale in October, just before the Global Bit Ventures deal. Although it was not mentioned in later registrations, or in any other Marathon Patent filing, Gilliam is the mother of Charles Allen. She also was a director of BTCS, and a large BTCS shareholder. A chart in Marathon Patent’s SEC filing on the revised bitcoin deal showed that Gilliam provided financing to Global Bit Ventures as well. She was to get the equivalent of 1.47 million additional shares through the deal, which would have been worth more than $1.3 milion at the current market price.

– Global Bit Ventures procured most of its bitcoin-mining equipment through a third company, BlockMaintain Inc. It was described as an affiliate of Alchimista Inc., based in Toronto. Alchimista took convertible notes as payment, and was to get 19 million of the 70 million Marathon Patent shares to be issued in the merger. Those shares would have a current market value of $17.3 million. We found that Alchimista is headed by Duncan Yuen, who co-founded MUNDOmedia with Jesse Theofilos. He and Theofilos also are co-founders of Alchimista. Corporation filings show that the two are owners of another Canadian company that was an early shareholder of Riot Blockchain.

– One of MUNDOmedia’s biggest shareholders, David Baazov, was facing criminal charges in Canada until early June, when the judge presiding over his trial ended the case. Authorities had alleged that Baazov engaged in insider trading and market manipulation while chief executive of an online gambling company formerly known as Amaya Inc. It is now The Stars Group Inc. (Nasdaq:TSG). The judge ruled on June 6 that prosecutors unfairly hindered the defense through repeated errors and delays in turning over evidence. We found that a company called Northurst Inc., which listed Baazov’s then-partner in a private equity firm as controlling shareholder, owned more than 5 percent of Riot Blockchain, and was one of the biggest investors in both Kairos and Global Bit Ventures. Another company listed as a significant investor in Global Bit Ventures was headed by Benjamin Ahdoot, a former Stars Group executive who was one of Baazov’s co-defendants in the criminal case. Northurst and Ahdoot were to get preferred stock equal to almost 26 million Marathon Patent shares through the merger. That stock would have been worth $22 million at the current market price.

– Marathon Patent said in a recent SEC filing that it leased an industrial building in Granby, Quebec, with the intention of using the facility and its low-cost hydroelectric power for bitcoin-mining operations. The lease agreement showed that the building was controlled by Robert Mincoff. He is another former Amaya/Stars Group executive and Baazov associate. Documents filed in connection with the lease showed he was working for Baazov’s Montreal-based private equity firm, Ahaka Capital, at the time.

– Catherine DeFrancesco teamed up with Honig last year in a proxy fight for control of Venaxis Inc., which ultimately became Riot Blockchain. She also was an investor in Majesco prior to its merger with PolarityTE. After acquiring sizable stakes in Venaxis, DeFrancesco and Honig demanded in separate letters to management that it remove five of its six board members and replace them with candidates that they put forward. Both of their proposed slates included O’Rourke, Stetson and Sutton.

In other words, Sutton — whose virtually unknown bitcoin company was suddenly valued at $185 million last November — was no stranger to Honig, O’Rourke, Stetson or others who reaped substantial profits from Marathon Patent’s bitcoin deal and would have reaped even more if the deal had gone through

In fact, our review of the 20 names on Global Bit Ventures’ investor list found that virtually all of them had prior connections to Honig’s group, through Marathon Patent, BTCS, Riot Blockchain, PolarityTE, MUNDOmedia, Opko or other public companies financed by Honig or Frost.

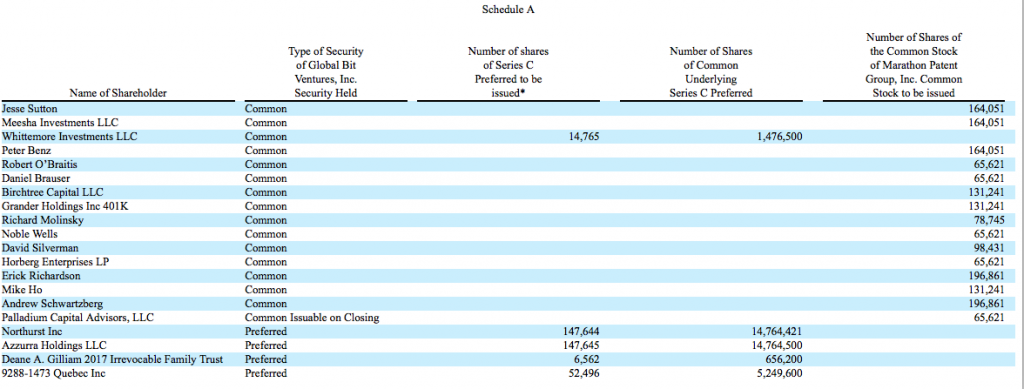

Global Bit Ventures shareholders

SIMILARITIES TO MGT CAPITAL INVESTMENTS

Marathon Patent’s acquisition of Global Bit Ventures has parallels to a deal in 2016 that produced a sharp increase in the share price and trading volume of another Honig-backed company, MGT Capital Investments.

MGT announced in May 2016 that it had agreed to acquire two small tech companies as part of a transformation that would bring antivirus pioneer John McAfee on board as chief executive and shift its business focus to cybersecurity. The deal called for MGT to issue more than 43.6 million shares as payment for the two tech businesses, Demonsaw LLC and D-Vasive Inc., even though they had little in the way of revenue, earnings or assets.

The shares were to go to the owners of those businesses, and to certain unidentified holders of their convertible notes.

MGT’s stock had been trading for less than 30 cents a share before the deal was announced. Within days, the price had topped $2.50 a share, and later climbed as high as $4.58.

The SEC opened an investigation, which is still active. After MGT disclosed that probe, the New York Stock Exchange announced that it would not allow any of the shares issued in those acquisitions to trade.

The NYSE later delisted MGT’s stock, which moved to the Over The Counter market. MGT wound up buying 46 percent of Demonsaw and terminating its deal for D-Vasive.

Documents in a lawsuit filed last year show that Barry Honig, Jonathan Honig, Stetson, O’Rourke and Groussman had provided $765,000 in financing to Demonsaw and D-Vasive shortly before MGT announced the acquisitions.

Their role in the Demonsaw and D-Vasive transactions was not disclosed at the time. According to one court filing, they expected to get 13.75 million MGT shares through the conversion of their notes. Those shares would have had a market value of more $30 million in the days after the deals became public.

Our review of the Form 13G filings that Honig submitted in February 2016 and September 2016 shows that he sold or disposed of more than 3 million previously acquired MGT shares in that period. If Honig sold all of his shares for an average price of $3, which is at the low end of the trading range during the surge, he would have collected $9 million.

Brauser, one of Honig’s longtime business partners, said in a Schedule 13G filing in May 2016 — just before MGT announced its move into cybersecurity – that he had acquired 7.4 percent of the company’s stock.

Brauser’s stake consisted of 1.3 million shares, plus warrants to buy a further 800,000 shares. It appears from the company’s SEC filings that those warrants were exercised shortly thereafter, at a price between 25 cents and 41 cents.

Brauser could have sold those 2.1 million shares during the surge for $6 million or more. He did not submit an amended Form 13G in 2017, even though filers are required to update their holdings at least once a year.

He did, however, file a final amended 13G in April, reporting that he no longer held any shares.

MGT parted ways with McAfee earlier this year, and said it was considering the sale or spinoff of its cybersecurity business. Like Marathon Patent and Riot Blockchain, it has pivoted into the bitcoin-mining business. Its stock now trades for around 75 cents.

The Honig brothers, Stetson, O’Rourke and Groussman recently dropped their suit against MGT, its chief executive, Robert B. Ladd, McAfee and three others. They were seeking as much as $47 million in damages for MGT’s failure to complete those transactions under the original terms and convert their notes to common stock.

FORTUITOUS TIMING

Our review of SEC filings for Marathon Patent, Riot Blockchain and PolarityTE found that participants in their capital raises benefited from especially good timing. They received large amounts of stock, convertible notes and warrants at favorable terms — in many cases right before major developments.

Revere acquired its interest in Marathon Patent on Aug. 31, two months before the company announced its plan to acquire Global Bit Ventures. An SEC filing shows that Marathon Patent got $3.6 million from Revere, Gilliam and another investor in exchange for notes that were convertible to common stock at 80 cents a share (adjusted for a reverse stock split in October).

Marathon Patent’s stock closed at $1.76 ( also adjusted) on the day the placement was completed, so the conversion price of the notes was less than half of the market price for the company’s shares.

Marathon Patent ultimately issued $5.5 million in notes, exchangeable for 6.9 million shares. Revere and the other funders also got warrants to buy an additional 6.9 million shares, at $1.20 each.

Our analysis of registration statements, Form 13G filings and other documents showed that:

– Revere bought $3.44 million of the first $3.6 million in notes. They were convertible to 4.3 million common shares.

– Gilliam bought $140,000 of the first tranche of notes. She converted them to 175,000 shares in September.

–Peter T. Benz, the founder of Viking Asset Management LLC and a longtime investor in Honig-backed companies, bought $35,200 of the first tranche of notes. He converted them to 44,000 shares in September.

–Revere bought all $1.85 million of the second tranche of notes. They were convertible to 2.3 million shares.

– Hudson Bay, a hedge fund manager that often invests in Honig’s deals, bought $224,282 of notes from Revere in late November. They were convertible to 280,352 shares and were registered for resale in December.

Revere wound up with $5.07 million in notes, which were convertible to 6.3 million shares. SEC filings show that $252,568 of the notes were exchanged for 315,710 common shares in early September.

BENEFICIAL TRANSFERS

We noted another set of transactions that put more shares into the hands of Honig’s associates shortly before the Global Bit Ventures deal was announced.

Marathon Patent had raised $2.7 million in April 2017 by selling shares at 70 cents each (not split-adjusted) to three buyers — Intracoastal Capital LLC; CVI Investments Inc.; and Anson Investments Master Fund LP.

Those three funds also got warrants to buy 2.3 million shares at 83 cents each. Intracoastal Capital has invested in a number of companies that were created or bankrolled by Honig, including Riot Blockchain. Anson Investments has provided capital to some of those same companies. The Marathon Patent deal did not turn out well for the funds. Within three months, the company’s share price had fallen by half.

In mid-July, however, Marathon Patent agreed to exchange the warrants — which were not yet exercisable and were well out of the money — for 598,500 shares of common stock (split-adjusted), with a market value of more than $700,000.

Marathon Patent’s SEC filings did not explain why it made that concession, and we found no language providing for that sort of exchange in the original investment agreement.

A registration statement that Marathon Patent filed in September revealed that two-thirds of those warrants no longer were held by their original owners. It showed that Intracoastal Capital sold its warrants, exchangeable for 198,000 shares, to Dr. Ronald Low. He is a New Jersey physician whose daughter is married to Jonathan Honig. The filing showed that Anson Investments sold its warrants, also exchangeable for 198,000 common shares, to Melechdavid Inc. That company is owned by Groussman.

Marathon Patent said in its annual SEC filing for 2017 that it completed the exchanges at the end of September.

If Low and Groussman sold their portions in October, they would have collected around $300,000 each. If they sold during the price surge in November and December, they could have collected more than $1 million each, or even as much as $1.5 million if they were able to sell near the peak.

A FAVORABLE EXCHANGE

Marathon Patent agreed to yet another swap in early August. According to SEC filings, it issued 502,750 shares of newly authorized Series D convertible preferred stock to the unidentified holder of a $500,000 convertible promissory note it had issued in 2014.

Marathon Patent said the new preferred stock could be converted to 628,000 shares of common stock, at 80 cents a share (both numbers split-adjusted).

What it didn’t say was that the note issued in 2014 was convertible at a rate of $7.50 a share. That would have yielded the holder just 66,667 shares. And the reverse split in October would have reduced that further, to 16,667 shares.

In other words, Marathon Patent once again entered into an exchange that was more beneficial to an individual security holder than it was to the company and its ordinary investors. And although the original loan agreement included a provision for reductions in the conversion price in the event of future capital raises at lower prices, Marathon Patent completed that exchange a week before it agreed to terms with Revere on the note sale.

We found three Marathon Patent investors who were listed in a November 2014 registration statement as holding 66,667 shares underlying convertible notes. One was Brauser. Another was an entity called Four Kids Investment Fund LLC. The filing listed Barry Honig’s father, Alan S. Honig, as managing member of that LLC. More recent SEC filings, including those by Riot Blockchain, listed Jonathan Honig as managing member.

The other noteholders whose shares had been covered by that registration included Barry Honig, Groussman, O’Rourke and Frost.

SEC filings show that the undisclosed recipient of the newly issued Series D preferred converted 200,000 shares on Aug. 9, 2017 and got 250,000 common shares (split adjusted). The holder converted the remainder of the preferred stock on Sept. 5 and Sept. 13, receiving 62,500 shares and 315,958 shares, respectively.

The 628,545 common shares issued through those three exchanges amounted to well over 5 percent of Marathon Patent’s common shares. But no one filed a Form 13D or Form 13G that directly disclosed ownership of that stock.

Groussman filed a Form 13G on Sept. 7, disclosing ownership of 739,150 common shares (split adjusted). That figure including 190,000 shares underlying the warrants he bought.

Groussman’s filing did not say how he acquired the other 549,150 shares. But as we noted earlier, a chronology of securities transactions in one of Marathon Patent’s later SEC filings showed that the company issued 62,500 on Sept. 5 through the conversion fo some of the Series D preferred stock, bringing the total issued to 312,500. That number alone would have been enough to trigger a Form 13G filing.

The common shares issued for that preferred stock could have been sold for more than $1 million in October. They could have been sold for $2.5 million or more during Marathon Patent’s surge in November and December.

REVERE CASHES IN

Marathon Patent’s initial prospectus covering the resale of stock underlying the convertible notes included 1.59 million shares (split adjusted) offered by Revere. It became effective in mid-October.

An amended filing in late November showed that Revere had sold $224,282 of its notes to Hudson Bay. They were convertible to a little more than 280,000 shares, and were included in the shares that Marathon Patent registered for resale.

According to the registration statement, that reduced the number of shares that Revere was eligible to sell to 1.31 million.

Marathon Patent’s annual financial report shows that $1 million in notes were converted to common shares from Nov. 20 through Nov. 27. Those dates coincide with the biggest surge in its stock price and trading volume.

Marathon Patent issued a total of 1.27 million shares for those notes. They clearly would have gone to Revere, as Gilliam and Benz already had converted their notes and Revere had yet to sell any notes to Hudson Bay.

The dollar amount of the notes converted on Nov. 20, 22, 24 and 27 was low enough that the number of shares issued each day fell below the 5 percent ownership threshold that would have triggered a Form 13D or 13G filing.

However, the total number of shares issued was equal to a 12 percent stake in the company, on a fully diluted basis (Marathon Patent had 8.7 million shares outstanding before the conversions, and 9.9 million after).

This means that Revere either quickly sold shares from each note conversion so that its total never topped 5 percent, or that it failed to disclose it had acquired 5 percent or more of Marathon Patent’s common stock.

On Nov. 22, Marathon Patent’s stock opened at $1.45. It reached an intraday high of $2.68, and closed at $2.18, with 14.7 million shares changing hands.

On Nov. 24, the stock opened at $3.45, reached an intraday high of $6.04 and closed at $5.95. Total volume topped 44 million shares.

On Nov. 27, Marathon Patent’s stock opened at $8.70, hit a high of $10.03 and closed at $6.95. More than 48 million shares changed hands, bringing the total volume for the three-day surge to more than 100 million shares.

If Revere sold its 1.27 million shares from the note conversions in equal installments on those three days, at a price equal to the average closing price for those days, it would have collected $6.4 million.

Marathon Patent registered an additional 2.53 million of Revere’s shares for resale in mid-December. However, the company ended the year with $4 million in notes still outstanding, so most of those shares had yet to be issued.

Marathon Patent said in its latest quarterly SEC filing that it issued 2.62 million shares through note conversions in the three months that ended March 31. That left it with a little under $2 million in notes outstanding.

Those numbers mean that Marathon Patent had issued 4.4 million shares via conversions through the first quarter, out of a maximum of 6.9 million. If we deduct the roughly 500,000 shares issued or issuable to Gilliam, Benz and Hudson Bay, that would mean 3.9 million of the shares from note conversions went to Revere, or should have gone to Revere.

Given that Revere received 1.6 million shares through note conversions in September and November, it follows that it got the other 2.3 million this year. A different SEC filing showed that Marathon Patent still had $4 million in notes outstanding as of Jan. 22, so the additional shares had to have been issued after that date.

If Revere got the 2.3 million shares in late January and sold them in the last week of the month, the proceeds would have been in the vicinity of $7.5 million, based on the average closing price of $3.30 a share for that period.

By those estimates, Revere’s sale of the first 3.6 million shares from its note conversions would have generated $13.9 million.

It’s possible that Revere did not sell the shares it received through those first-quarter conversions. But if that were the case, it should have filed a Form 13D or 13G disclosing ownership of 5 percent or more of the company’s shares.

Those 2.3 million shares would have equaled more than 15 percent of Marathon Patent’s outstanding shares.

Marathon Patent said in its latest quarterly SEC filing that it issued a further 1.2 million shares via note conversions in April. That left the company with around $1 million in outstanding notes.

The common shares underlying the remaining notes would have had a market value of $1.1 million at the current share price.

THE WARRANTS GET EXCHANGED

Revere and the other buyers of the convertible notes last year got roughly 6.9 million warrants, exercisable at $1.20 each (both numbers split-adjusted).

SEC filings show that on Nov. 28, the day after Marathon Patent’s share price peaked, the company and the holder of 6.6 million warrants agreed to exchange the warrants for a new series of preferred stock.

We think that even though Revere sold some of its notes, it retained the warrants. That lines up with one holder owning 6.6 million. But as we mentioned previously, none of Marathon Patent’s registration statements listing Revere as a selling shareholder included the warrants or the preferred stock among its holdings.

The 5.5 million common shares underlying the preferred stock that Marathon Patent issued to replace the warrants had a market value of more than $22 million at the start of the year.

SEC filings show that 3.57 million of the preferred shares were converted between Jan. 22 and March 31. The newly issued common shares amounted to more than 18 percent of the total outstanding. Once again, no one submitted a Form 13D or Form 13G disclosing ownership of more than 5 percent of Marathon Patent’s shares.

If the 1.2 million additional shares issued through note conversions in April are added, then Marathon Patent distributed 4.8 million new common shares through the conversion of notes or warrants/preferred stock originally issued to Revere.

That equals nearly 25 percent of Marathon Patent’s current total.

If Revere or some other party or parties sold the 3.6 million shares from the conversion of preferred stock, and those sales came in February or the first half of March, the proceeds would have totaled $7.2 million or more, based on the average closing prices.

Those would have been unregistered sales, however.

The sheer number of shares issued through the conversion of preferred stock and notes this year would appear to violate the beneficial ownership limits included in the financing agreement with Revere.

According to a letter that the company’s chief financial officer sent to O’Rourke just before the Global Bit Ventures deal, the beneficial ownership limit on the notes was 2.49 percent of Marathon Patent’s outstanding shares. The letter said that could be increased to 9.99 percent with 61 days’ notice.

The preferred stock had a beneficial ownership limit of 4.99 percent of the company’s outstanding shares, and a maximum of 9.99 percent under a waiver.

O’Rourke, who had sole voting and investment authority over the securities held by Revere, did not respond to written questions submitted by Sharesleuth.

We noted that Marathon Patent’s transfer agent is Equity Stock Transfer LLC. It also is PolarityTE’s transfer agent, and was Riot Blockchain’s transfer agent for the special dividend that company paid to common and preferred shareholders in October.

Equtiy Stock Transfer’s chief executive is Mohit Bhansali. He was a director of Majesco Entertainment until March 2017, the month before it completed its merger with PolarityTE. He also was one of the investors who bought shares and warrants in Riot Blockchain through a private placements last April, when it was still known as Bioptix.

SEC filings show that Equity Stock Transfer has received operating capital from Paradox Capital Partners LLC. Paradox Capital is managed by Harvey Kesner, a partner in Sichenzia Ross Ference Kesner LLP in New York. Kesner and his firm have acted as securities counsel to Marathon Patent, Riot Blockchain and PolarlityTE.

Paradox also has been an investor in Marathon Patent, Riot Blockchain and Majesco Entertainment.

REVERE’S BOTTOM LINE

By our calculations, Revere’s $5.1 net investment in Marathon Patent’s notes has returned $20 million or more.

That consists of:

– $13.9 million from share sales

– $3.7 million from common shares issued for recent note and preferred stock conversions (based on current market value)

– $1.1 million in common shares underlying its remaining notes (based on current market value)

– $1.6 million in common shares underlying the remaining preferred stock (based on current market value)

Marathon Patent raised an additional $12.5 million in capital in November, through a pair of registered direct offerings to accredited investors. None of the purchasers has been identified in the company’s SEC filings.

Marathon Patent ended last year with $14.5 million in cash. SEC filings show that by the end of the first quarter, that total had dwindled to $5.4 million, largely because the company spent $5.8 million on the purchase and installation of bitcoin-mining equipment.

THE HONIG GROUP’S PROCEEDS

We calculated that members of Honig’s group have sold more than $15 million of Marathon Patent stock since October.

That consists of:

– $13.9 million from Revere’s sale of shares linked to convertible notes.

– $1 million to $3.6 million from the sale of shares linked to Series D preferred stock.

– $600,000 to $2.4 million from Groussman’s and Low’s sale of shares exchanged for warrants.

If Revere and the other sellers were able to unload some of their holdings at prices toward the high end of our estimates (for instance, selling at the peak range of $8 to $10 a share), the total proceeds could have approached or exceeded $22 million.

If Revere – or some other holder or holders — sold any of the additional 4.8 million shares issued this year through the conversion of notes and preferred stock, that would have added millions of dollars more to the total.

RELOADING VIA GLOBAL BIT VENTURES

As we noted previously, O’Rourke’s Azzurra Holdings stood to receive the equivalent of 20.5 million common shares under the revised Marathon Patent-Global Bit Ventures merger agreement.

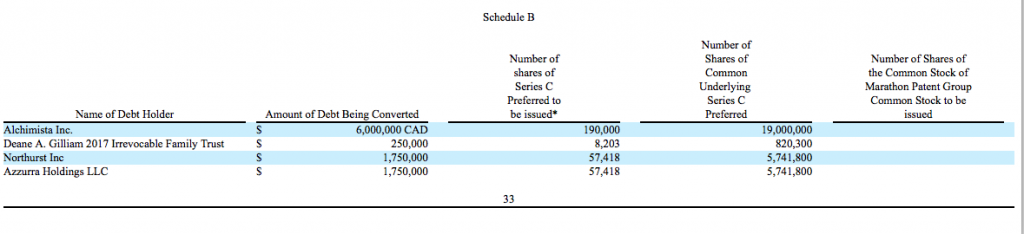

Marathon Patent’s April 4 filing included a copy of the new agreement, along with charts showing how many shares each of the holders of Global Bit Ventures’ common stock, preferred stock and notes were to receive. Those charts were not included in the original filing in November.

It showed that two entities controlled by Brauser – Grander Holdings Inc. and Birchtree Capital LLC – were to get just over 260,000 Marathon Patent shares in the merger. One of Brauser’s sons, Daniel, was to get 65,621 shares.

The last page of the filing was a list of agreements related to the merger. One was labeled “Purchase Agreements in connection with Company Debt between the Company and each of Barry Honig, Deane Gilliam, HS Contrarian Investments LLC and Northurst Inc.”

The designation “Company” in that document referred to Global Bit Ventures.

The language suggested that Honig and HS Contrarian Investments were among the original purchasers of Global Bit Ventures’ convertible notes prior to the merger agreement. If that was true, then it appears that they transferred the notes to Azzurra, which was listed elsewhere in the filing as one of four holders of convertible notes, along with Gilliam, Northurst and Alchemista, which financed the bitcoin-mining equipment.

Global Bit Ventures Noteholders That filing showed that Azzurra held $1.75 million in Global Bit Ventures notes. It was to get preferred stock equal to 5.74 million Marathon Patent shares for those notes, meaning its average price per share would have been around 30 cents.

That filing showed that Azzurra held $1.75 million in Global Bit Ventures notes. It was to get preferred stock equal to 5.74 million Marathon Patent shares for those notes, meaning its average price per share would have been around 30 cents.

Marathon Patent’s current market price is roughly three times higher than that. The filing showed that Azzurra also was to get the equivalent of 14.8 million common shares for its preferred stock in Global Bit Ventures.

CANADIAN MONEY

Like Azzurra, Northurst stood to receive the equivalent of 20.5 million common shares in the Marathon Patent-Global Bit Venture merger.

Our review of SEC filings found that Northurst also owned more than 5 percent of Riot Blockchain, and was the biggest shareholder of Kairos, the first bitcoin miner that Riot Blockchain acquired.

Riot Blockchain’s filings listed Northurst’s controlling shareholder as Jakub Malczewski. He also was managing director of Ahaka Capital, which was an investor in MUNDOMedia alongside Honig, O’Rourke, Steston and Groussman.

Malczewski’s partner in Ahaka Capital was David Baazov.

Malczewski told Sharesleuth that he ended his affiliation with Northurst in February. He added that Baazov was not an owner of Northurst. But corporation filings show that Northurst’s new president is yet another former employee of Baazov’s online gambling company. And a recent Canadian securities filing related to a different bitcoin deal listed Northurst as an investor alongside both of Baazov’s co-defendants in the criminal case.

Our search of SEC filings found that Honig’s group had direct ties to Baazov at another company, Function(x) Inc. (OTC: FNCX). Honig, O’Rourke, Stetson, Groussman and Baazov were the holders of $3.3 million in convertible notes in that company, most of which it issued in its acquisition of Rant Inc. in August 2016.

All five of them sold their notes in a joint transaction last August.

Honig, Brauser and Hudson Bay provided $3 million in financing to Rant in 2013, with a commitment to provide an additional $5 million. O’Rourke also invested in the company, and had a seat on Rant’s board of directors..

Marathon Patent’s recent SEC filings show that two of the original officers and directors of Kairos, the bitcoin miner that Riot Blockchain acquired, also were shareholders of Global Bit Ventures. The two, Michael Ho and Moses David Silverman, were to get 131,241 and 98,431 Marathon patent shares, respectively, from the Global Bit Ventures merger.

Silverman, who runs a mortgage company in Maryland, also goes by M. David Silverman. He was an investor in PolarityTE, and is a former director of Therapix Biosciences Ltd. (Nasdaq: TRPX). Stetson disclosed in an SEC filing last April that he held a 5.9 percent stake in the company, which is seeking to develop cannabinoid-based treatments for Tourette Syndrome and other ailments. Groussman serves on Therapix’s board.

The SEC filing on the revised terms of the Marathon Patent merger showed that Sutton and Allen, the two people who supposedly created Global Bit Ventures, were to get just 1.64 million shares in the combined company.

That was less 3 percent of the total consideration that would change hands in the deal.

Four other people listed as holders of Global Bit Ventures’ common stock also bought shares of Riot Blockchain through a private placement in April 2017, when it was still known as Bioptix and had not yet begun to invest in cryptocurrency businesses.

They were to get 538,088 shares in the merger of Marathon Patent and Global Bit Ventures.

Three of those four also were investors in a PolarityTE placement that accompanied its reverse merger with Majesco.

We will have more on those overlapping relationships in part two of our package.